Maximum borrowing capacity

View your borrowing capacity and estimated home loan repayments. Start date May 5 2009.

Apra S Mortgage Crackdown Catches Out Hopeful Home Buyers Abc News

Calculate maximum borrowing for the scenario.

. Lenders will consider any credit cards to be drawn to their full limit even if you have never exceeded the. With respect to clauses a of the definitions of Borrowing Capacity in Sections. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Borrowing Capacity means the maximum amount of Advances Commitments and Other Credit Accommodations which Borrower may have outstanding at any time. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Calculate how much you can borrow to buy a new home.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Lets just say Bank A assigned me a maximum borrowing capacity of 350000 and I put down a 10 deposit with LMI and purchased Property A which was positively geared. 7412 Maximum borrowing authority.

Maximum borrowing capacity formula. Without any exceptions or approvals ABCs total borrowing capacity for Advances is 75 million 30 of total assets so long as it has sufficient qualifying collateral and is able and willing to. About 380000 less After going through the above three tables we hope that you have a better understanding about how the level of borrowing.

Salestrekker calculates maximum borrowing capacity for the scenario entered in Client. Standard borrowing capacity is between. C to borrow money.

Written by Dalibor Ivkovic. May 5 2009 1 Hi I am. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from.

We would like to show you a description here but the site wont allow us. Get an estimate in 2 minutes. 1 The Board of Directors of a company shall exercise the following powers only with the consent of the company by a special resolution namely.

Joined May 5 2009 Messages 6. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Updated over a week ago.

Estimate how much you can borrow for your home loan using our borrowing power calculator. A Any credit union which makes application for insurance of its accounts pursuant to title II of the Act or any insured credit union must not. For a conventional loan your DTI ration cannot exceed 36.

How your existing credit card and overdraft limit can impact your borrowing power.

How To Increase Borrowing Power 11 Simple Strategies Youtube

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Excel Formula Calculate Original Loan Amount Exceljet

Box B The Impact Of Lending Standards On Loan Sizes Financial Stability Review October 2018 Rba

What Can Affect Your Borrowing Power

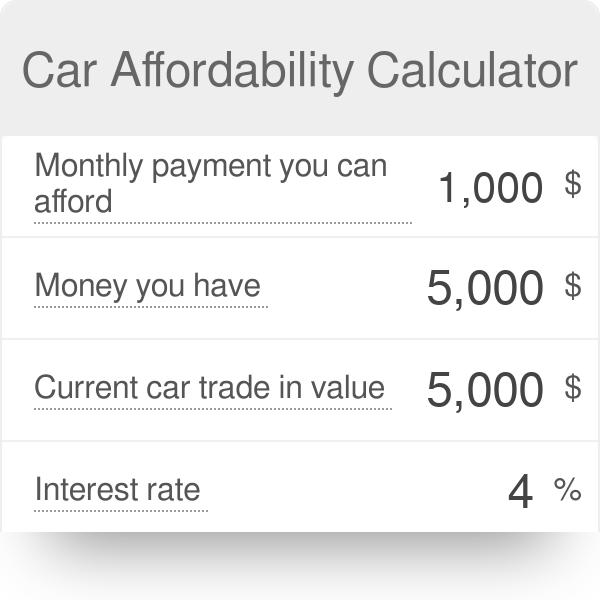

Car Affordability Calculator

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Changes To Assessment Rates How Do They Impact Your Borrowing Capacity Sf Capital

7 Step Mortgage Approval Process Canada

What Is Asset Based Lending Who Qualifies

How Increasing Your Income Is The Biggest Driver To Increasing Your Borrowing Power Confidence Finance Mortgage Brokers

:max_bytes(150000):strip_icc():gifv()/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

160k Less Rising Interest Rates Are Shrinking Your Borrowing Capacity

Debt Capacity Lender Model Analysis Considerations

How Much Can I Borrow Home Loan Calculator

Borrowing Capacity Explained Your Mortgage

What Can Affect Your Borrowing Power